Financial Reporting Implications of COVID-19: In-Depth Analysis for Service-Based Entities

The COVID-19 outbreak took the world by surprise and triggered a VUCA1 situation which resulted in operational and financial disruptions in entities operating in any sector. Given this disruption, it is critical for financial controllers, auditors, financial analysts, and other users of financial statements to understand and assess the impact of this crisis on financial statements. Using the International Financial Reporting Standards (IASs and IFRSs), I have compiled a list of accounting issues and considerations that practitioners and professionals can refer to while dealing with accounts, in an attempt to pave the way for relevant, reliable and faithfully represented financial information. In this article, I will address service-based entities of which I selected eight major industries. If you are interested in asset-based industries, you can refer to the article: Financial Reporting Implications of COVID-19: In-Depth Analysis for Asset-Based Entities.

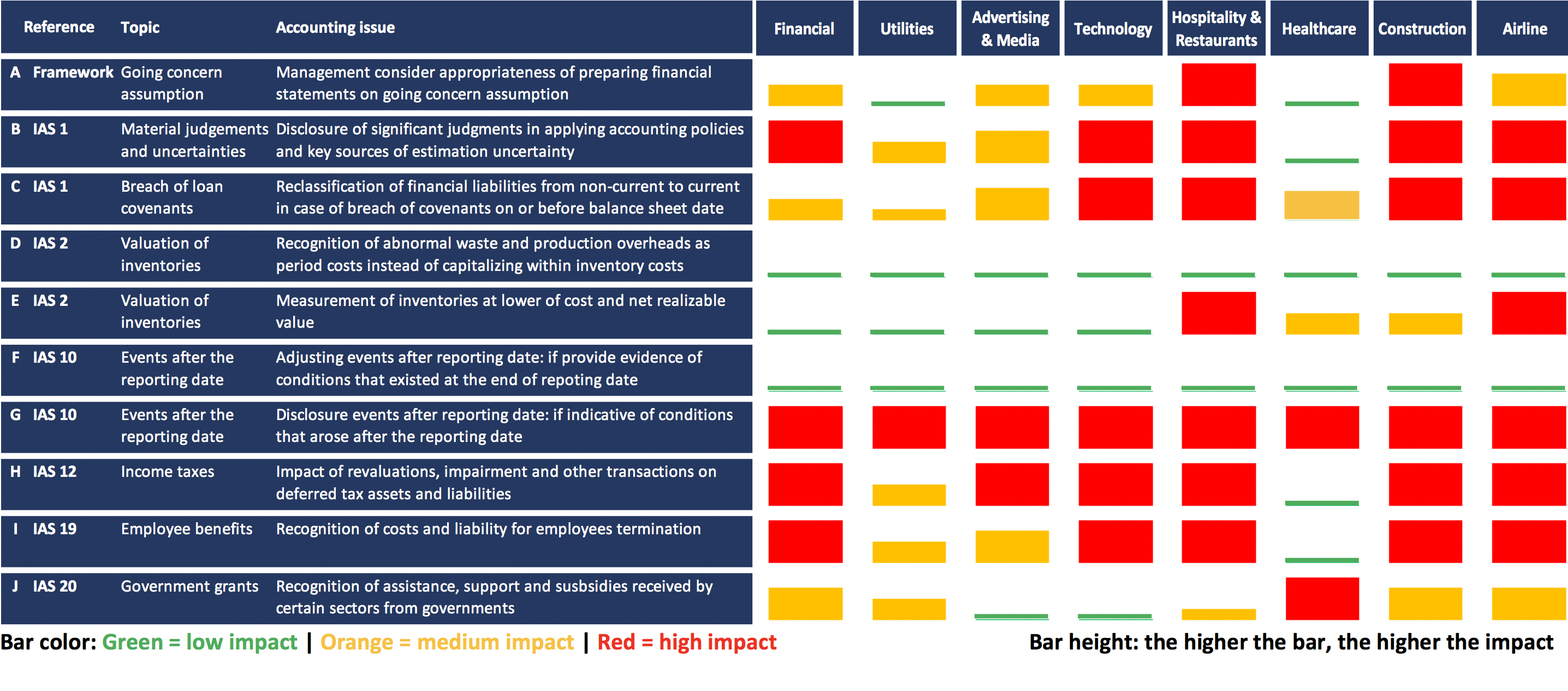

The extent of impact by a specific accounting issue is indicated by the bar color and height (this is a matter of professional judgment by the author rather than a fact). For ease of reading, I divided the financial reporting issues into three Groups: Group 1: Framework to IAS20, Group 2: IAS 23 to IFRS 7, Group 3: IFRS 7 to IFRS 17.

Group 1: Framework to IAS 20

A more detailed explanation of accounting considerations and impact by industry for group 1 is provided below:

A. The crisis might result in conditions that can cast significant doubt upon an entity’s ability to continue as a going concern. Based on judgement, the two industries most affected are hospitality (due to suspension of travel and lockdowns) and construction (due to delay and deferral of projects). The least affected are utilities and healthcare industries as they are considered necessary services. In between are all other remaining industries. The defragmented nature of the airline industry and possible government support protects it from going into liquidation or ceasing trading. As for technology entities, the need for digitization, virtual working, and virtual learning provides a boost for the survival of organizations offering market solutions. Advertising and media are less impacted by the crisis as ads viewership increased during periods of lockdown. Financial institutions are highly negatively impacted by the crisis. However, since those institutions are highly capitalized, the possibility of their liquidation is medium.

B. Most industries will be required to make disclosures of significant judgments and key sources of uncertainty. An example are judgments related to expected credit loss from loan portfolios held by financial institutions and trade receivables held on the balance sheets of remaining industries. Revenue recognition is also an area requiring judgment (e.g. in complex cases involving multiple element arrangements for advertising, technology and construction industries). Other areas of judgment and uncertainties for all industries would be recognition and measurement of provisions for restructuring and employees’ termination, obligations for long-term employee benefits, assumptions underlying estimation of recoverable amount for impairment tests, and fair value measurements that depend on significant unobservable inputs. Healthcare is the least impacted from these uncertainties whereas utilities are in-between.

C. Industries that are expected to face pressures on their cash flows might opt to default on their loan repayments and/or breach loan covenants. Industries with the highest pressure on their cash flows are technology, hospitality, construction, and airlines since they need to cover their high outflow towards fixed operational costs and sometimes exit payments for employees. Hospitals operating in the healthcare industry are also expected to face high cash flows pressures since reimbursement of medical claims from insurers and governments might not be received within a duration that matches their cash outflows and liabilities. Industries with the least pressure on cash flow are utilities as users will continue settling their water and electricity bills to avoid interruption of service.

D. Recognition of abnormal waste and production overheads as a period cost or product cost capitalized within inventory is more of a concern for manufacturing entities. Therefore, service-based industries are not highly impacted by this accounting issues.

E. Service-based industries that hold inventory at the end of a reporting period will need to measure inventory at lowest of cost or net realizable value. Hotels, restaurants, and airlines are expected to hold unsold inventory of food items or consumables at the end of reporting periods. Hospitals that perform elective surgeries, cosmetics surgeries, and alternative medicine sessions might have those activities suspended as a precautionary step to prevent the spread of COVID-19 and therefore, inventory held by hospitals to supply these services might become obsolete and lose value as of the end of reporting period. The remaining industries are not expected to hold material balances of inventory.

F. The COVID-19 outbreak is considered a major event after the reporting period. However, its impact is not expected to provide evidence of conditions that existed at the end of the reporting period of December 31st, 2019. Nevertheless, if the entity initiated some impairment tests on long-lived assets, or compared inventories’ net realizable value to their carrying amount after the reporting period, or performed an in-depth assessment on provisions resulting from COVID-19, and realized that those losses existed as of December 31st, 2019, then the entity should consider recognizing these losses as of the end of the reporting period of December 31st, 2019. Entities preparing their interim financial statements at March 31st, 2020 are expected to include the impact of COVID-19 on their financial statements as of that date.

G. As a follow-up to point F, COVID-19 probably triggered a set of non-adjusting events after the reporting period which are material. Hence, the nature and financial effect of those event should be fully disclosed by all industries. As per IAS 10 Events After the Reporting Period, examples of non-adjusting events are a decline in market value of investments between the end the reporting period and the date when the financial statements are authorized for issue, disposal of major subsidiaries, announcing a plan to discontinue an operation, classification of assets as held-for-sale as per IFRS 5 Non-Current Assets Held-for-Sale and Discontinued Operations, implementation of a major restructuring, major ordinary share transaction in an attempt to pump liquidity into the entity, abnormally large changes after the reporting period in asset prices, entering into significant commitments or contingent liabilities or commencing major litigation arising solely out of events that occurred after the reporting period.

H. The crisis and post-crisis periods are expected to result in temporary differences between tax base and accounting base of assets and liabilities due to recognition and reversal of impairment losses, revaluation of assets to new fair values, and recognition of provisions and allowances. Therefore, this will result in recognition and reversal of deferred tax assets and liabilities. Moreover, entities that have recognized deferred tax assets on their balance sheets are required to assess the need to recognize a valuation allowance against the deferred tax asset balance to show the amount with a more than 50% probability of not being utilized in the future due to non-availability of sufficient future taxable income.

I. Many entities are expected to undergo major restructuring which entails, among other actions, laying off employees. Therefore, a termination benefit liability might be recognized. Financial institutions, technology, hospitality, construction and airlines are the most highly impacted. Advertising and utilities are in between. The healthcare industry is the least expected to undergo restructuring and is the least impacted by this accounting issue.

J. Some industries are expected to receive government grants, support, and subsidies based on the country’s priorities and types of industry. Hospitals operating in the healthcare industry are expected to be the major beneficiary of support from charities, non-profit organizations, and the government, which will help them sustain their operations during these challenging times. As for government subsidies and support, based on history, it is expected that large financial institutions, construction giants, and airlines will receive such support as governments attempt to save their economies from an eventual crash. Advertising and technology entities are not expected to receive meaningful government support.

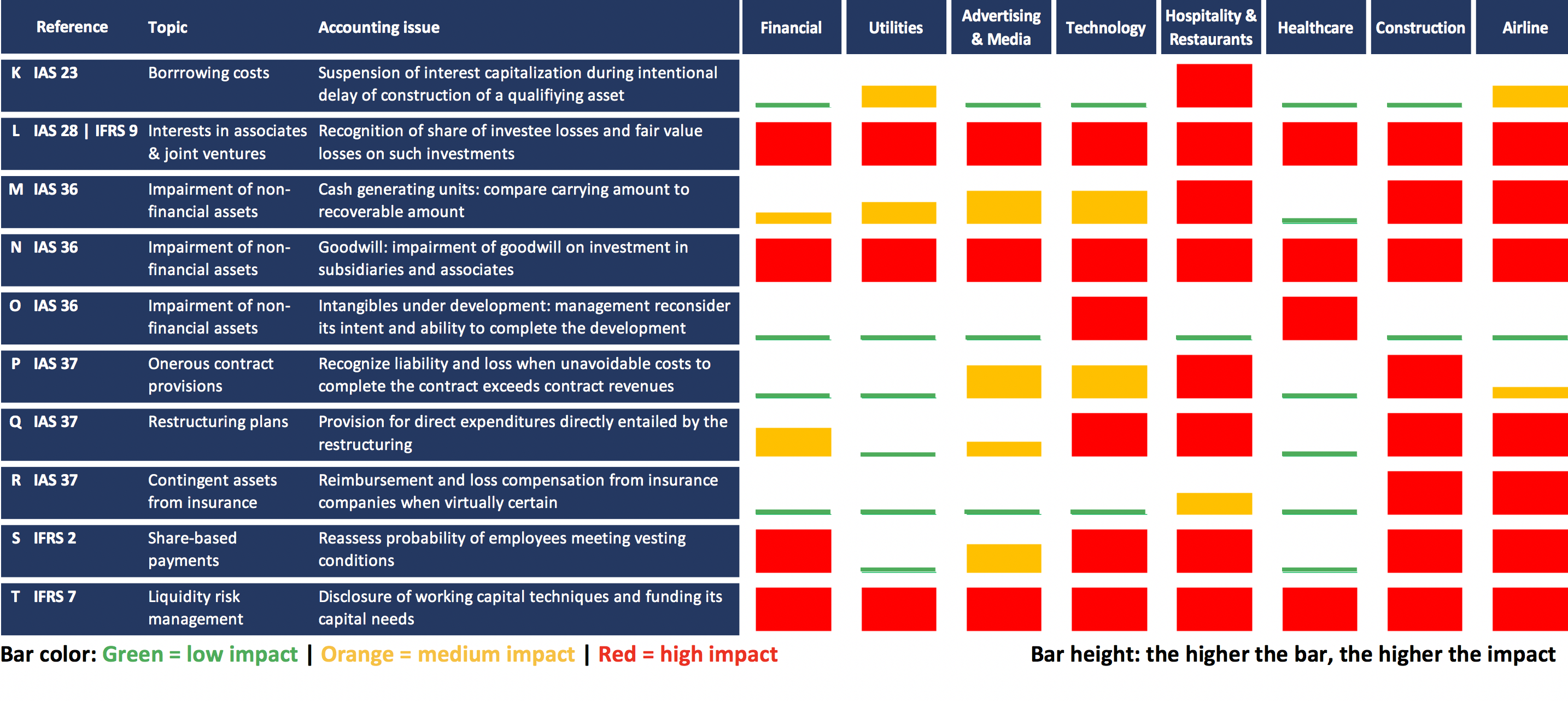

Group 2: IAS 23 to IFRS 7

A more detailed explanation of accounting considerations and impact by industry for group 2 is provided below:

K. While the COVID-19 outbreak remains uncontained, most entities will be required to suspend the manufacturing or construction of some or all of their assets. During the period of suspension, interest charges incurred on debt used to finance these assets should be recorded as period expense rather than capitalized to cost of asset. Industries expected to have assets under construction are hospitality and restaurants. The remaining service-based entities are not expected to have major capital assets, except in the instance of the construction of headquarters. Airline industries fall in between as they might have orders for airplanes which are being currently manufactured for them by suppliers.

L. An entity operating in any service industry might hold one or more long-term interests in associates and joint ventures operating in one more industry. All entities must pay close attention to the extent of recognition and reversal of losses from these interests if the entity is accounting for this interest based on the equity method in accordance with IAS 28 Investments in Associates and Joint Ventures. If the entity holds an interest measured at fair value (example preferred shares) or at amortized cost (example long-term loan) as per IFRS 9 Financial Instruments, the extent of recognition and reversal of losses should also be monitored.

M. As per IAS 36 Impairment of Assets, an entity is required to assess at the reporting date whether there are any indicators of impairment of its assets or more broadly its cash-generating-units. Considering the COVID-19 outbreak, there are both external and internal indicators that an impairment might have occurred. Indicators in the service industries include, but are not limited to, interruption of construction works, suspension of flights operations, closure of hotels and restaurants, decrease of market interest rates, and reduced demand and selling prices for goods and services. Less indicators of impairment of cash-generating-units exist for healthcare, financial institutions, and utilities while medium-to-high indicators exist for advertising and technology industries.

N. An entity operating in any service industry might have one or more investments in subsidiaries which resulted in goodwill upon business combination. Those entities are required to test for goodwill impairment at least annually. With the COVID1-19 outbreak and stock markets losses, the possibility of goodwill impairment is higher than ever and entities should place a higher emphasis on this matter.

O. As per IAS 36 Impairment of Assets, intangible assets which are not available yet for use should be tested for impairment at least annually. Industries expected to have intangibles under development are technology entities developing solutions and applications as well as hospital research centers developing medicine and drugs. Both industries mentioned might defer or reconsider the completion of those intangibles due to change in management intent to complete the development, ability to use or sell the intangible, or availability of adequate technical, financial, and other resources to complete the development and to use or sell the intangible asset. Other industries in service sectors are less likely to have intangibles under development.

P. Due to supply chain interruptions, paid leaves of workers, and delays resulting from imposed lockdowns, the unavoidable costs to be incurred by a vendor to meet the obligations under certain service contracts might exceed the economic benefits expected to be received under it. Those are considered as onerous contracts and therefore, the present obligation under the contract should be recognized and measured as a provision. Contractors in the construction industry are expected to be the most highly impacted by this accounting issue. This also applies to hotels which have agreements to supply services to certain customers, sometimes at highly discounted fares, as they need to increase their suffering occupancy rates. Technology, advertising and airlines are expected to have a medium impact from losses on onerous contracts while financial institutions, utilities, and healthcare are expected to have a low impact.

Q. Many entities are expected to undergo restructuring activities during or post the outbreak. Examples of events include sale or termination of a line or business, closure or relocation of business locations, and changes of management or operational structure. Once the restructuring criteria are met, the entity should recognize a provision. The most highly impacted industries are expected to be technology, hospitality, construction, and airlines, followed by financial institutions. The least impacted industries are healthcare and utilities while advertising/media are expected to be positioned in the middle.

R. Some entities purchase “business interruption insurance” that covers the loss of income that a business suffers after a disaster or economic crisis. While this is not a common practice for most industries, construction, airlines, and possibly hotel chains might have that insurance. The entity must consider the recognition and/or disclosure for a separate asset for the expected reimbursement when reimbursement is virtually certain.

S. For entities which offer equity-settled to counterparties, the grant of equity instruments might be conditional upon satisfying specified vesting conditions. For example, a grant of shares or share options to an employee is typically conditional on the employee remaining in the entity’s employ for a specified period. There might be performance conditions that must be satisfied such as the entity achieving a specified growth in profit or a specified increase in the entity’s share price. Given the slowdown faced by entities in the financial, technology, hospitality, construction, and airline industry, it will be more challenging for the vesting conditions to be satisfied and/or for employees to complete the vesting period. Therefore, the entity must reconsider the adequacy of the amounts recorded. As for cash-settled share-based payments offered by entities to counterparties, the entity must monitor closely the fair value of the equity instruments granted, which will impact the liability measured.

T. IFRS 7 Financial Instruments: Disclosures requires entities to make certain disclosures about the entity’s ability to meet obligations associated with financial liabilities that are settled by delivering cash or another financial asset. Entities might revert to specific measures to manage liquidity during this crisis such as liquidation of long-term investments, factoring of receivables, restructuring of current liabilities, or reverse factoring. Any service entity will be highly impacted by these measures and will be required to provide adequate quantitative and qualitative disclosures.

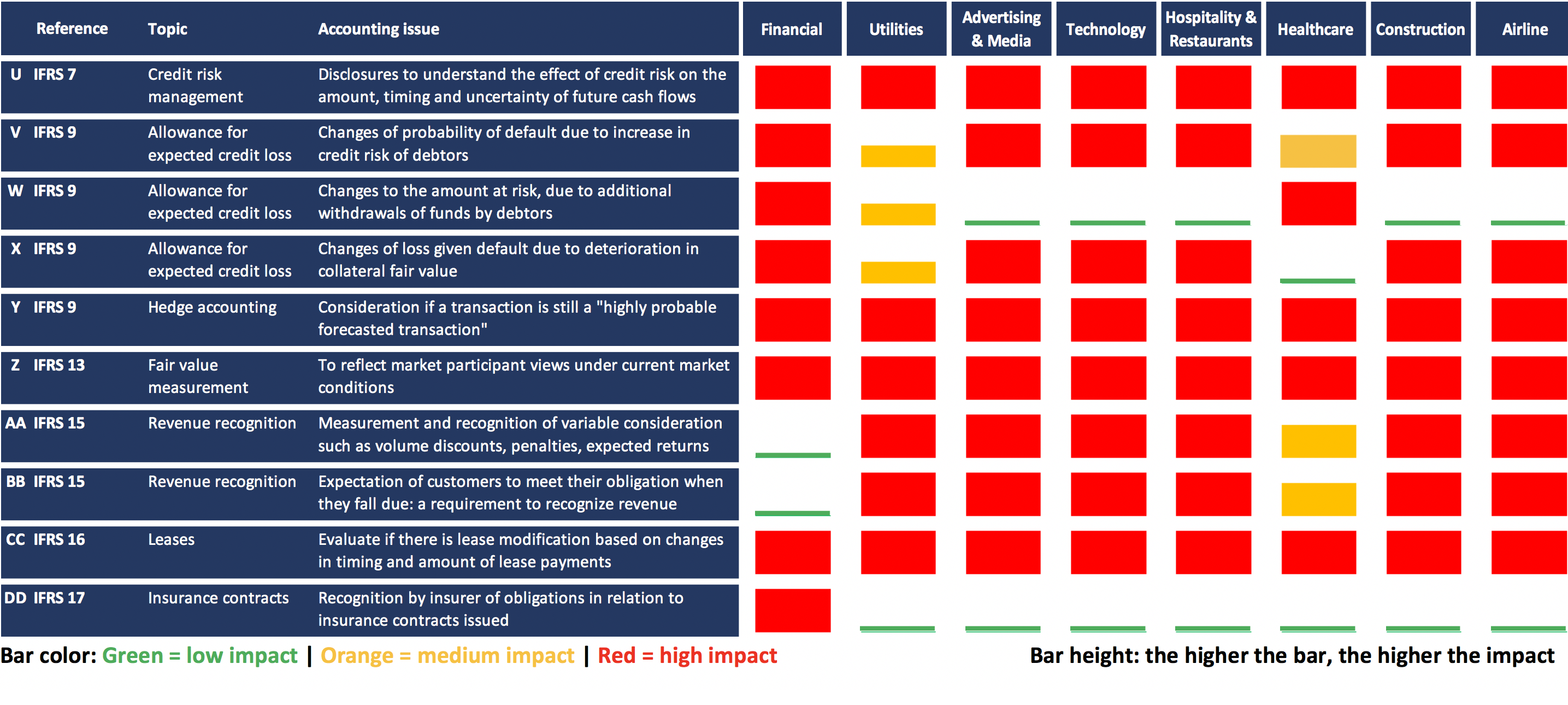

Group 3: IFRS 7 to IFRS 17

A more detailed explanation of accounting considerations and impact by industry for group 3 is provided below:

U. IFRS 7 Financial Instruments: Disclosures requires entities to make certain disclosures that enable users to evaluate the nature and extent of risks arising from financial instruments to which the entity is exposed to at the end of reporting period. Quantitative and qualitative disclosures are required so that users understand the effect of credit risk on the amount, timing, and uncertainty of future cash flows. Since the crisis has resulted in an increase of credit risk exposure for most entities, an entity should consider how it will disclose the impact on its financial assets and the credit risk management practices it has in place to identify and manage credit risk. Examples of such disclosures would cover the concentration of exposure to activities in areas or industries affected by the outbreak (e.g. utilities entity with a major customer base of hotels and restaurants) and possible credit rating downgrades for investments in financial assets held by the entity as of the end of reporting period.

V. Entities should consider the impact of COVID-19 on their expected credit loss calculations. As a start, an entity must assess whether there have been significant increases in credit risk on financial instruments since initial recognition. For financial instruments with a significant increase in credit risk over the remaining life of the instrument in comparison with the credit risk on initial recognition, the entity should start calculating the expected credit loss (ECL) based on the lifetime ECL rather than 12-month ECL. Moreover, due to the pandemic’s severe effect on debtors’ creditworthiness, entities should also assess whether an objective evidence of impairment exists at the reporting date for certain financial instruments to move quickly from stage 1 to stage 3. Industries most likely affected by this accounting issue would be the financial, advertising, technology, hospitality, construction, and airlines industries. Healthcare is also highly impacted since its major client is the insurance industry which is facing heavy pressures and an increasing number of claims. The utilities industry will experience a lower impact given the expectation that consumers will still consume and pay for their water and electricity services.

W. Continuing on point “V” above, the amount at risk might change since some debtors might consume available facility limits to cover working capital needs, salaries, and other cash expenses. The increase of amount at risk is highly likely for the financial industry while it is the least likely for the advertising, technology, hospitality, construction, and airlines industries which will try to limit their exposure of receivables from customers to the balances already due. Healthcare is expected to have an increase in the amount at risk due to the accumulation of receivable balances from insurance entities. Utilities might have an increase in exposure due to a delay in payments by users. This delay, however, is not expected to be major.

X. Continuing on points “V” and “W” above, the loss given default would be impacted. For measuring ECL, the estimate of expected cash shortfalls should reflect the cash flows expected from collateral and other credit enhancements that are part of the contractual terms and are not recognized separately by the entity. Since the value of collaterals provided by debtors might decrease due to a drop in market values, the loss given default might consequently increase.

Y. The coronavirus outbreak disrupted operations and supply chains which will ultimately affect the probability of hedged forecasted transactions occurring during the time period designated at the inception of a hedge. Entities that have hedging transactions will need to determine whether they can still apply hedge accounting to the forecasted transaction or a proportion of it.

Z. IFRS defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. It should also reflect market participant views and assumptions used when pricing the asset or liability. The impact of this crisis on fair values will be reflected in calculations related to long-lived assets revaluations, impairment testing, government grants, financial instruments measured at fair value, discontinued operations, and others. Therefore, the calculation should take into consideration the current market conditions and market participants view.

AA. For some customer contracts, the amount receivable by a service provider may be impacted by a wide range of variable considerations such as discounts, rebates, refunds, credits, price concessions, incentives, performance bonuses, penalties or other similar items. IFRS 15 Revenue from Contracts with Customers requires that the estimated amount of variable consideration is recognized only to the extent that it is highly probable that a significant reversal in the amount of revenue recognized will not occur when the uncertainty is resolved. Entities are required to reconsider their estimates of variable consideration and whether they expect a reversal to revenue will occur considering the current crisis. For example, construction entities should assess the probability of penalties on late delivery of projects, hotels should assess the probability of price concessions and discounts for customers to encourage higher occupancy, and airlines should consider how deferred revenues on loyalty programs will be impacted given that the probability of expiry and forfeiting of the accumulated balance might change. All industries are affected by this accounting issue except for the financial industry since its main revenue is interest income which is outside the scope of IFRS 15 Revenue from Contracts with Customers.

BB. One of the criteria for entities to recognize revenue as per IFRS 15 Revenue from Contracts with Customers is that it is probable that the consideration for the exchange of the goods or services that the vendor is entitled to will be collected. For the purposes of this criterion, only the customer’s ability and intention to pay amounts when they become due are considered. Since the crisis has affected the ability of customers to settle the transaction price when it falls due, entities should reconsider if revenue should be recognized for certain customers and transactions. All industries are affected by this accounting issue except for the financial industry since its main revenue is interest income which is outside the scope of IFRS 15 Revenue from Contracts with Customers.

CC. To support lessees during the crisis, lessors and lessees might change the scope of a lease or revise the conditions of existing lease agreements. This might include concessions on the amount and/or timing of payments, free rent periods, or other incentives. Lessees and lessors need to assess whether these revisions constitute a lease modification as per IFRS 16 Leases. These modifications are not expected to be accounted for as a separate lease at the effective date of the lease modification. Both lessor and lessee accounting for a lease as a finance lease should reallocate the consideration in the modified contract, determine the lease term of the modified lease, and remeasure the lease liability/receivable by discounting the revised lease payments using a revised discount rate. For operating leases by lessors, the lessor shall account for a modification to an operating lease as a new lease from the effective date of the modification. Since all industries are involved in lease transactions, all industries are affected by the lease issue.

DD. Insurers and reinsurers who issue insurance contracts will have to consider requirements of IFRS 17 Insurance Contracts to recognize insurance obligations in relation to insurance contracts. For example, entities issuing health or medical insurance will have to cover claims on COVID-19 tests and treatment while insurers might have to cover claims for business interruption insurance, event cancellation insurance, travel insurance, and credit insurance.

Note: this material has been prepared by the author for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice.

1VUCA stands for Volatile, Uncertain, Complex and Ambiguous.

Related Articles

Conversations with AI: Accounting for Leased Assets by the Lessee

I had a conversation with AI “Claude 3.5” regarding IFRS 16 and the requirement…

Kaali Peeli Epiphany: Unveiling the Currency of Contentment

Lao Tzu once said The one who knows he has enough is rich. This is an…

Increasing Your RETURNS-20 Curve While Flattening the COVID-19 Curve

It has only been a few months since the COVID-19 pandemic began. Yet,…

Lebanon’s Deposits Crisis: Who’s to Blame? Us or Them?

Let’s travel backward to February 2019. A typical Lebanese citizen, whether…