Saudi Arabia’s Economy: A Paradigm Shift and the Road Ahead

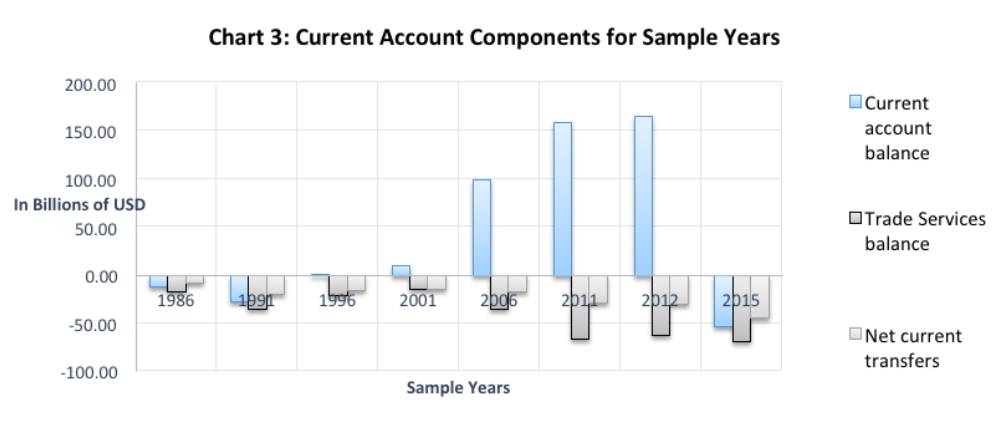

Saudi Arabia (KSA) represents around 45% of the GCC economy and is the biggest economy in the Middle East. Living in the Gulf, nothing intrigues me more than looking at the drift of KSA’s key economic indicators in the year 2015 compared to 2012.

Love and hate story between KSA and oil: KSA holds 18% of the world’s proven oil reserves, produces daily an average of 15% of global oil production, and oil exports constitute 90% of KSA’s annual exports which means that oil prices have been a major catalyst for KSA’s economic performance. This is a happy story as long as oil prices are consistently high and KSA is able to export its oil production to trading partners such as China and the USA. But the story becomes a nightmare when the USA discovers shale oil fields, develops technology to make its production economical, announces it will become self-sufficient in the near future and oil prices are slashed by half.

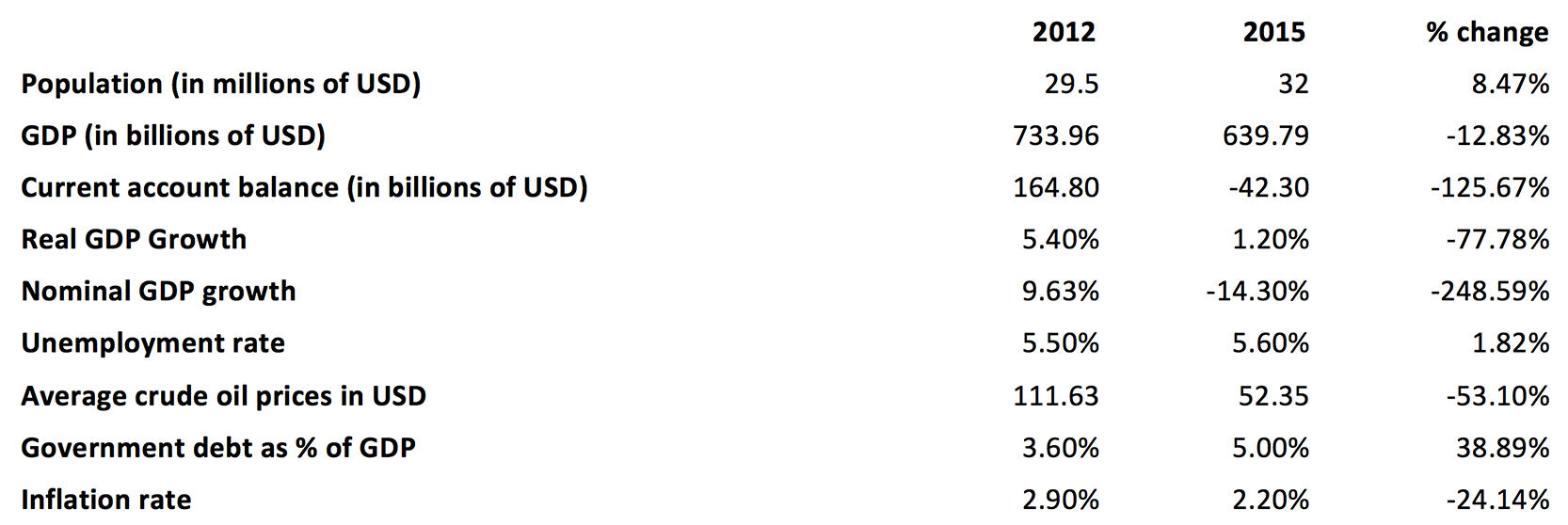

GDP: KSA’s nominal GDP value increased steadily, approximately doubling every 10 years, going from $87 billion in 1986, to $158 billion in 1995, and from $375 billion in 2006 to $646 billion in 2015. The record year was 2014 when the GDP reached $754 billion.

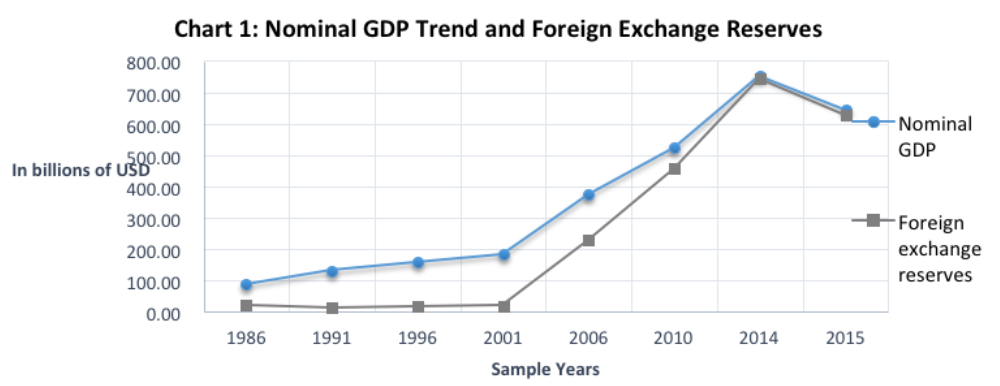

During those 30 years, KSA experienced only 5 decreases in GDP, and they were directly correlated with severe drops in oil prices such as in 1998, 2009 and 2015 when average oil prices dropped by 33%, 37% and 47% respectively from their previous year.

Household consumption represents a major component of GDP at around 30%, followed by government consumption and gross capital formation, each of which represents around 25% of GDP. Net exports usually represent 20% of GDP, except in years of crisis when oil prices drop. In those years net exports shrink to 5%-10% of GDP and even sometimes scoring net inflows. Such drops in exports are usually compensated by higher government spending.

GDP growth rate: When we look at real GDP growth rate, which is economic growth adjusted for inflation, we see that it has been moving in line with nominal GDP growth. The fastest growth decade was between 1986 and 1995 when growth rates touched record highs of 17%, 13%, 15% and another 15% in 1986, 1988, 1990 and 1991, respectively. The following decades, from 1996 through 2005 and 2006 through 2015, do not show major fluctuations in real GDP growth which was mostly positive except in 1998-1999 and 2009 when the economy contracted due to the Asian financial crisis and the global financial crisis.

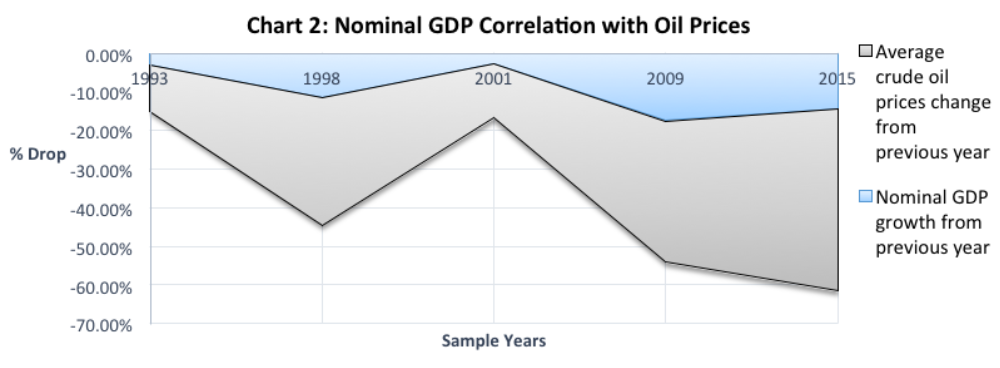

Current account balance: KSA’s current account balance was negative every year from 1986 through 1995 with an average deficit of $12 billion a year. The situation changed in the following decade when, from 1996 through 2005, the annual trade surpluses caused by the increase of 50% in oil prices lead to an average current account surplus of $20 billion a year, peaking to a $90 billion surplus in 2005. The only year during that period that saw a current account deficit (that amounted to $13 billion) was in 1998, due to the Asian financial crisis. During the following decade, the rate of increase in the current account balance remained healthy from 2006 to 2012, when it reached a record high of $165 billion, followed by a downturn in 2013 which caused a decrease in the current account to $135 billion and a deficit of $53 billion in 2015, due to the drop of 53% in oil prices that occurred between 2012 and 2015.

Throughout the 30 year period starting in 1985 and through 2015, the balance of services showed deficits due to high imports of consulting services and the outward payment for royalties which were only partially offset by religious tourism for Omra and the Hajj season. Also, net current transfers were negative every year of that 30 year period due to charitable contributions and major donations made by KSA to external countries.

Financial account balance: In the years of current account deficit, which lasted till 1995, the financial accounts showed funds flowing from abroad mainly in the form of bank and government loans. When KSA started showing current account surpluses, we saw that its foreign direct investments abroad and its foreign portfolio of investments remained relatively low, while its foreign exchange reserves grew fast, indicating a conservative strategy of investing its surpluses. (Refer to Chart 1 years 1986 through 2014)

Exchange rates: KSA’s Saudi Riyal (SAR) has been pegged to the US dollar since the early 80’s to avoid currency fluctuation and remove uncertainties in cross-border dealings. Foreign exchange reserves are used to protect the peg and had been growing from 1985 till 2014. Lately those reserves decreased from their peak of $753 billion in 2014 to $629 billion in 2015 and to $536 billion in 2016. These foreign exchange reserves were used to fund a budget deficit that amounted to $100 billion in 2015 and $83 billion in 2016, and also as a means to protect the SAR from depreciating. In the past two years, falling oil prices shrunk the USD inflows coming from dollar-denominated exports of oil. With a stable and high demand of USD needed to repay any USD debt, the government sold foreign reserves and bought SAR in order to maintain the SAR at its pegged value. Any weakness in the value of the SAR would make KSA’s USD based debt repayment more expensive. (Refer to Chart 1 year 2015)

Monetary policy: KSA issued $17 billion dollar-denominated government bonds in 2016 to finance the government’s budget deficit. Additionally, SAMA implemented a hike in Saudi Interbank Offering Rate (SIBOR) from 0.75% in 2015 to 2.25% in mid-2016 to follow the monetary policy direction of the US where the Fed is increasing its interest rates. Following the Fed’s interest rate moves is necessary to avoid arbitrage; otherwise, with the SAR pegged to USD, higher interest rates in the US would drive investors to sell SAR, buy USD and invest in the US, thereby putting pressure on the SAR. On the downside, the increase in SIBOR acts as a restrictive, and slows down the economy at a time when an expansionary policy is mostly needed. According to SAMA, “a 100 basis point increase in SIBOR leads to a decline of 90 basis points in GDP in the subsequent quarter and 95 basis points in the quarter after that”.

Fiscal policy: KSA’s government cabinet has approved the introduction of a value added tax effective January 1st 2018, which means the end of tax-free living and lower disposable income to be spent by consumers. Another tax introduced in June 2017 is the excise tax which is chargeable on the import or production of excise goods such as soft carbonated drinks, energy drinks and tobacco products. These new taxes will reduce the profits of businesses and the disposable income of consumers which will slow down household consumption and economic growth. In addition, the government started facing budget deficits, which in 2014 amounted to $24 billion and which quickly quadrupled to $100 billion in 2015. As a reaction the government has cut government expenditures which decreased from $304 billion in 2014 to $267 billion in 2015 and then to $230 billion in 2016 by cutting public-sector wages and energy subsidies.

Road ahead: Ceteris paribus, if oil prices do not change, and current accounts and budget balances continue scoring deficits at the same levels as 2015 and 2016, KSA’s foreign exchange reserves will totally dry up in 13 to 15 years. KSA’s government has realized that speculation and hopes of a recapture in oil prices is not a solution for economic recovery, and accordingly, other sources of non-oil revenues are needed. Major changes that will be implemented are:

- Selling up to 5% of Aramco’s share in IPO thereby generating around $100 billion in cash to be invested by KSA’s Public Investment Fund

- Introduce a Saudi green card that allows people to move and invest in KSA taking a long term view

- Restructuring military spending deals and tie them to Saudi manufacturing

- Fighting corruption and better performance measurement mechanisms for government bodies

- Linking Europe and Asia by developing the King Salman’s bridge which can trigger vast investments and development opportunities, and help moving cargo across the Red Sea

- Charging higher fees on expats which will reduce remittance outflows outside KSA

- Lifting subsidies implemented on everyone, including ministers and princes.

In my opinion, KSA’s government made a brilliant hedge by assuming that we are witnessing a paradigm shift in the economy which makes agility and proactivity a motto for the coming decade. But the question remains, will other GCC member states follow suit or will they miss the train?

Related Articles

Conversations with AI: Accounting for Leased Assets by the Lessee

I had a conversation with AI “Claude 3.5” regarding IFRS 16 and the requirement…

Kaali Peeli Epiphany: Unveiling the Currency of Contentment

Lao Tzu once said The one who knows he has enough is rich. This is an…

Financial Reporting Implications of COVID-19: In-Depth Analysis for Service-Based Entities

The COVID-19 outbreak took the world by surprise and triggered a VUCA…

Increasing Your RETURNS-20 Curve While Flattening the COVID-19 Curve

It has only been a few months since the COVID-19 pandemic began. Yet,…